Purpose?

The CRA has two purposes:

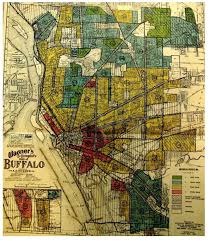

To redress the

impact of redlining.

To encourage banks to meet the credit needs of all segments of the communities in which they serve – including low – to – moderate income individuals and neighborhoods.

A new study shows, 3 out of 4 neighborhoods “redlined” on government maps 80 years ago continue to struggle today economically.” – Washington Post